Better Financial Literacy With Gamification: Collaborating with Bank Jago

Let’s face it, understanding how money works, and more importantly, how it can work to our benefit, has become increasingly crucial over the years. This is especially true when you consider the dynamic changes in the global economy, including the rise of financial alternatives such as digital wallets, online banks, and cryptocurrencies. Not to mention, the 2019 National Survey on Financial Literacy and Inclusion (SNLIK) even revealed a financial literacy index of 38.03% and a financial inclusion index of 76.19%. This data indicates that the Indonesian population still lacks a comprehensive understanding of various financial products and services offered by formal institutions.

As a result, those trusty school textbooks written just five years ago, or even the latest editions that we just bought, start to feel outdated pretty quickly. This realization underscores the urgent need for innovative learning methods that can keep pace with our ever-changing financial ecosystem.

Financial literacy is key to achieving greater financial inclusion and development. Honing our skills in planning and managing personal finances is crucial for building a resilient and sustainable well-being. A constantly updated financial education empowers us not only to make informed decisions about saving and investing but also to mitigate risks that could negatively impact our financial security. Furthermore, updated financial literacy promotes financial inclusion by equipping individuals with the skills needed to access and utilize financial services effectively. The question is, is there such a thing?

Short answer, yes, there is. Recently, Level Up powered by Agate has just collaborated with PT Bank Jago Tbk to create a financial literacy education in the form of a game or gamification. In February 2024, they launched Jago Money Quest, a groundbreaking interactive web-based game for financial education accessible through jagomoneyquest.com. This isn’t just any game though. In line with the United Nations Financial Health Framework, Jago Money Quest takes players on a simulated financial journey through eight levels. You’ll start as a freshman, navigating student life, and progress all the way to graduation and your first job.

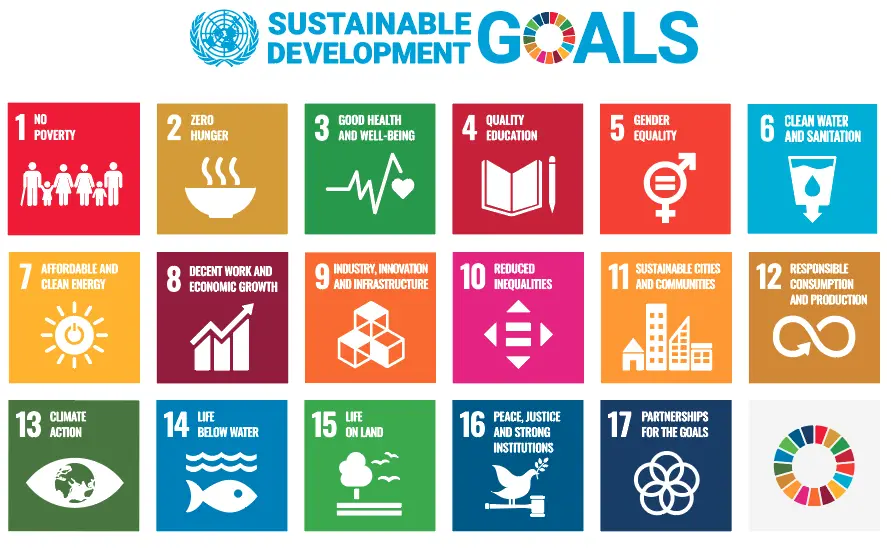

This approach aligns perfectly with several of the United Nations’ Sustainable Development Goals (SDGs). Here’s how:

Goal 1: No Poverty

Financial illiteracy is a significant barrier to poverty reduction. By equipping young people with the knowledge and skills to manage their finances effectively, Jago Money Quest empowers them to make informed choices that can lead to financial security and break the cycle of poverty.

Goal 4: Quality Education

As we mentioned before, traditional education often falls short when it comes to practical financial literacy. The Jago Money Quest game fills this gap by providing an engaging and interactive platform for young people to learn essential financial concepts. This complements formal education, ensuring a well-rounded understanding of financial matters.

Goal 8: Decent Work and Economic Growth

Financial literacy is a cornerstone of economic empowerment. By fostering responsible financial management among young people, Jago Money Quest prepares them to participate more actively in the workforce. This can lead to increased savings, better investment decisions, and ultimately, contribute to overall economic growth.

Bank Jago’s Agenda

Bank Jago’s Head of Sustainability & Digital Lending, Andy Djiwandono, expressed that Jago Money Quest goes beyond just the numbers. The game encourages players to consider other crucial factors impacting financial decisions, like health and time management. The goal? To empower younger generations to become financially responsible, confident managers of their money and set sustainable long-term goals.

Bank Jago’s collaboration with Level Up powered by Agate, highlights their commitment to innovative and accessible financial education. Through trial and error over two years, Level Up powered by Agate’s development team ensured that the game resonates with the experiences of students.

As Andy Djiwandono explains,

“We found that everyone, young or old, wants to be financially secure, but everyone faces unique challenges. This game is designed to be relevant to students before they graduate and enter the workforce, so they can start making informed financial decisions early on.”

Jago Money Quest is truly a powerful tool with the potential to transform financial literacy for the younger generation. By aligning with the UN’s SDGs and utilizing innovative teaching methods, Bank Jago is taking a proactive step towards building a future where financial well-being is accessible to all.

United Nations Sustainable Development Goals

To align with the UN Sustainable Development Goals (SDGs) framework, as mentioned before, Jago Money Quest was built with Indonesian college students in mind. This web-based game, developed by Level Up powered by Agate in collaboration with Bank Jago, aims to provide a deeper understanding and awareness about the importance of financial literacy and financial health.

Here’s how Jago Money Quest uses gamification to make learning fun and engaging:

Simulating Real-Life Money Management

Jago Money Quest throws you right into the thick of things. You’ll make everyday financial decisions in a safe, virtual environment. Through gameplay, you’ll learn how to budget, save, and make informed choices about your money, all in a format that’s both accessible and engaging.

Assessment and Feedback

The game incorporates an assessment element that reveals your financial personality. This valuable feedback helps you identify areas for improvement and develop a personalized financial strategy for the real world.

Appealing Visuals

Learning doesn’t have to be boring! Jago Money Quest features eye-catching illustrations that enhance the gameplay experience and keep you engaged throughout.

Choice-Driven Narrative

The game throws you curveballs, but unlike real life, you get to see how your choices play out. Jago Money Quest introduces scenarios where your decisions shape the storyline. This interactive element adds another layer of depth and allows you to experience the consequences of your financial choices firsthand.

Aligning with the UN Financial Health Framework

Jago Money Quest is meticulously designed to align with the UN Financial Health Framework, ensuring players gain a comprehensive understanding of financial well-being. The game progresses through eight levels, each focusing on a specific financial concept:

Levels 1-2: Security (Spending Routine, Planning & Budgeting)

Here, you’ll master the basics of money management. You’ll learn to manage daily needs, create effective budgets, and understand how housing choices impact your monthly costs, health, and stamina. This introductory level also teaches you the importance of saving for emergencies and unexpected expenses.

Levels 3-4: Resilience (Emergency, Loan, Insurance & Borrowing)

Life throws curveballs, and Jago Money Quest prepares you for them! You’ll encounter emergency scenarios that test your financial resilience. The game explores the role of loans, insurance, and savings in navigating these challenges. You’ll learn about different loan options, like Pay Later services, and understand the value of health insurance in protecting your financial well-being.

Levels 5-6: Control (Needs vs Wants, Now vs Later)

As you progress, the game introduces more complex financial considerations. You’ll face situations that test your impulse control and challenge you to differentiate between wants and needs. Jago Money Quest also introduces the concept of investments through deposits, encouraging you to consider long-term financial goals.

Levels 7-8: Freedom (Earn More & Compounding Interest)

By reaching these final levels, you’ll demonstrate your financial literacy through quizzes and culminating in a choice that shapes your future. You might decide to start a business, continue your studies, or enter the workforce. Here, the game offers more opportunities to increase your income, such as upskilling for freelancing and exploring various investment options. With the financial knowledge acquired throughout the game, you’ll be equipped to thrive through passive and active income generation.

In conclusion, with “Jago Money Quest,” developed by PT Bank Jago Tbk in collaboration with Level Up powered by Agate, we’ve taken a significant step forward in financial literacy. This approach of integrating financial education with gamification is a promising stride towards promoting financial literacy among the youth. By creating more engaging experiences like this, we can equip the next generation with the necessary skills to navigate not only the complex world of personal finance, but also other ever-changing landscapes of life. Through Bank Jago’s mission and dedication to financial education, combined with Level Up powered by Agate gamification expertise, is a promising step towards promoting financial literacy among the youth. By making learning about finance fun and engaging, it hopes to equip the next generation with the skills they need to navigate the complex world of personal finance.

Learn about our collaboration with Bank Jago here.

If you are interested in learning more about gamification and how it can benefit you or your organization

Check out our gamification services page and contact us today. We are ready to help you create a gamification experience that aligns with your needs and preferences.

Article Authors

Junialdi Dwijaputra

Dias Setyanto

Related Articles

- All Posts

- All

- All-EN